About My Portfolio

These articles showcase business and market research I’ve authored, whether it’s covering company news, documenting industry disruptors, or identifying new trends and exploring their impact on the world around us.

My work is about bringing down the high knowledge barrier associated with complex topics and making them accessible to a wider audience of readers.

Don’t forget to check out my Muckrack page for more on my portfolio!

Canada Bank Watchdog Warns of Housing-Payment Shock by 2026

May 22, 2024

Canada’s banking watchdog warned that many homeowners who took out mortgages when rates were near zero during the pandemic will soon face a reckoning as those loans renew.

Read it now on Bloomberg

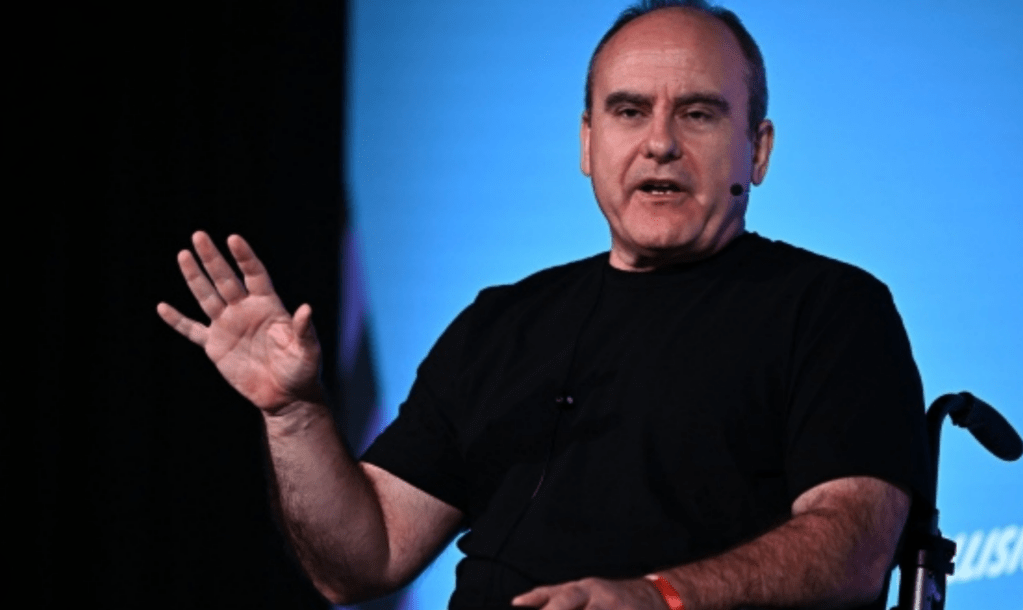

Lightspeed to Keep Dasilva as CEO Amid Push to Boost Growth

May 16, 2024

Canadian point-of-sale firm Lightspeed Commerce Inc. said founder Dax Dasilva will stay on as chief executive officer as the company seeks to focus on the next phase of its growth.

Read it now on Bloomberg

TD Risks ‘Lost Decade’ in US Money-Laundering Scandal, Jefferies Says

May 06, 2024

A veteran Canadian bank analyst says Toronto-Dominion Bank’s role in an alleged money-laundering scheme has made the “worst-case scenario” more likely — a huge fine for the lender and years of restrictions on its US growth.

Read it now on Bloomberg

Loblaw CFO Pushes Back on Claims Its Food Pricing Practices Are Unfair

May 03, 2024

A senior executive at Loblaw Cos. pushed back against criticism of the supermarket chain’s prices, arguing that the presence of global giants such as Walmart Inc. helps ensure a competitive market in Canada.

Read it now on Bloomberg

Rogers Investors Still Await Shaw Payoff But Analysts Say Rebound Will Come

April 26, 2024

Rogers Communications Inc. investors were supposed to reap the benefits when the company’s megadeal with Shaw Communications Inc. finally closed a year ago. They’re still waiting.

Read it now on Bloomberg

Maverix’s Ruffolo Warns Trudeau of Capital Flight After Tax Hike

April 23, 2024

A prominent Canadian technology investor joined the chorus of Canadian businesses criticizing Prime Minister Justin Trudeau’s decision to raise the capital-gains tax, arguing it will cause capital flight from the country.

Read it now on Bloomberg

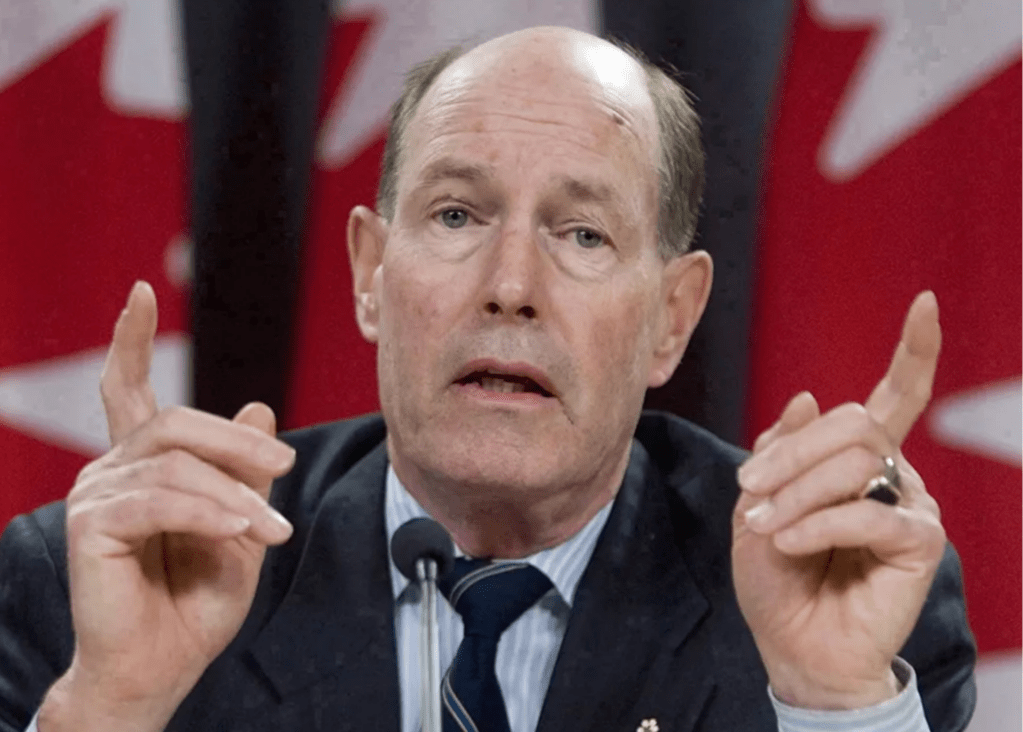

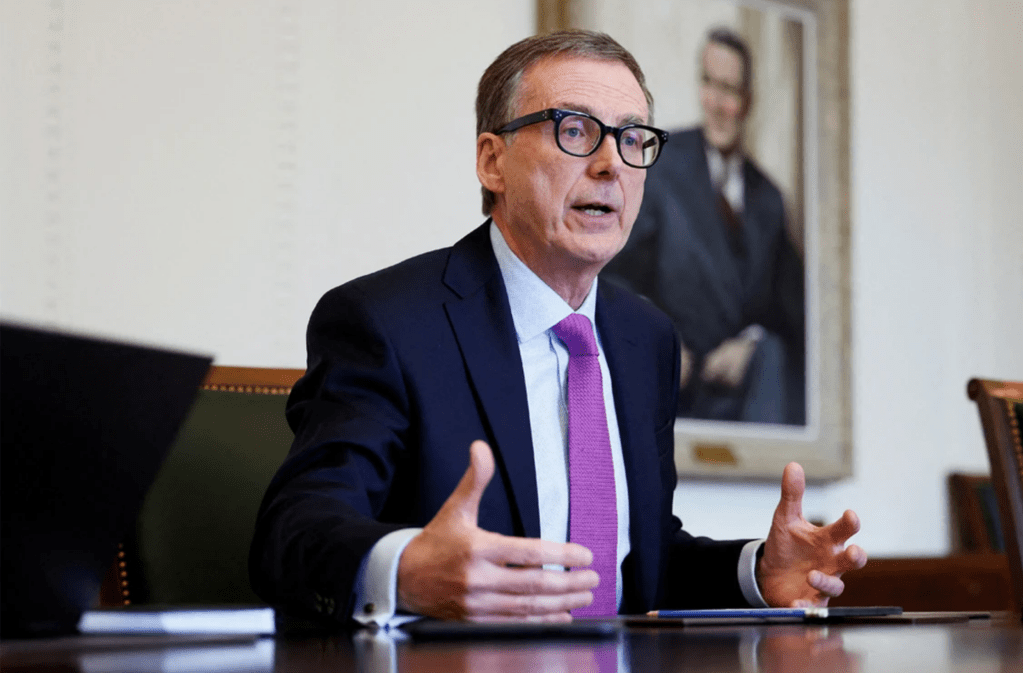

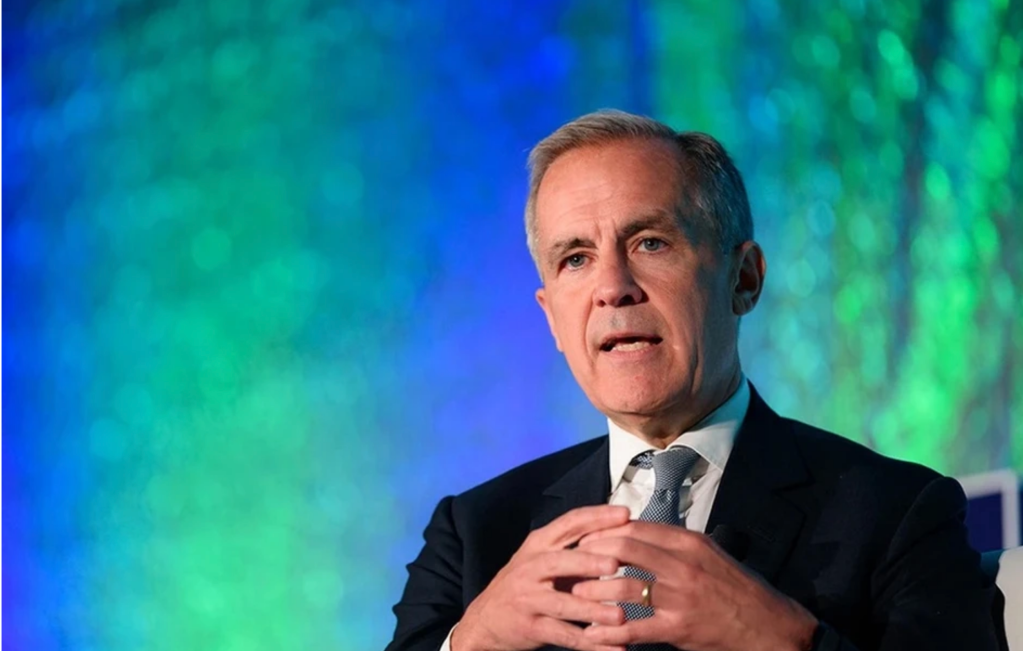

Former Bank of Canada Governor Says Freeland’s Budget Hurts Inflation Fight

April 18, 2024

Former Bank of Canada Governor David Dodge said the increase in spending in the federal government’s new budget will make the central bank’s battle against rising prices more difficult.

Read it now on Bloomberg

Firms Say Canada Tax Move Risks Deeper Productivity Slump

April 16, 2024

Canada’s decision to increase capital gains taxes was criticized by businesses who warned the move would only exacerbate the country’s investment and productivity woes.

Read it now on Bloomberg

Dollarama Shares Hits All-Time High as Holiday Store Sales Beat

April 04, 2024

Canadian discount retailer Dollarama Inc.’s stock hit a fresh all-time high as consumers shifted to lower-cost goods over the holiday period.

WSP Global Caught in Short Seller’s Crosshairs, Shares Fall

April 03, 2024

WSP Global Inc. shares plunged after Spruce Point Capital Management LLC said it was shorting the Canadian engineering firm’s stock, slapping it with a “strong sell” recommendation.

Read it now on Bloomberg

BCE Hits 10-Year Low, Rogers Dips After BMO Turns Sour on Telecom Outlook

April 02, 2024

Shares of BCE Inc. tumbled to the lowest in more than a decade and Rogers Communications Inc. suffered its biggest drop of 2024 after BMO Capital Markets published a darker outlook on Canada’s telecom sector.

Read it now on Bloomberg

Ontario Delays Balancing Budget by Another Year as Deficit Grows

March 26, 2024

Ontario’s budget shortfall is projected to more than triple in the coming fiscal year, as the government of the most populous Canadian province delays its goal of balancing its budget by another year.

Read it now on Bloomberg

Ontario to Spend on Housing, Transit Even With Swelling Budget Deficit

March 26, 2024

Ontario’s government will put infrastructure spending high on its list of priorities when it delivers a new budget Tuesday, even at the risk of joining Quebec and British Columbia with even larger deficits.

Read it now on Bloomberg

Canada’s S&P/TSX Composite Sets New Closing High

March 21, 2024

Canada’s equities benchmark index closed at a new all-time high Thursday on the backs of bank stocks, surging commodity prices and a rally in the country’s growing tech sector.

Read it now on Bloomberg

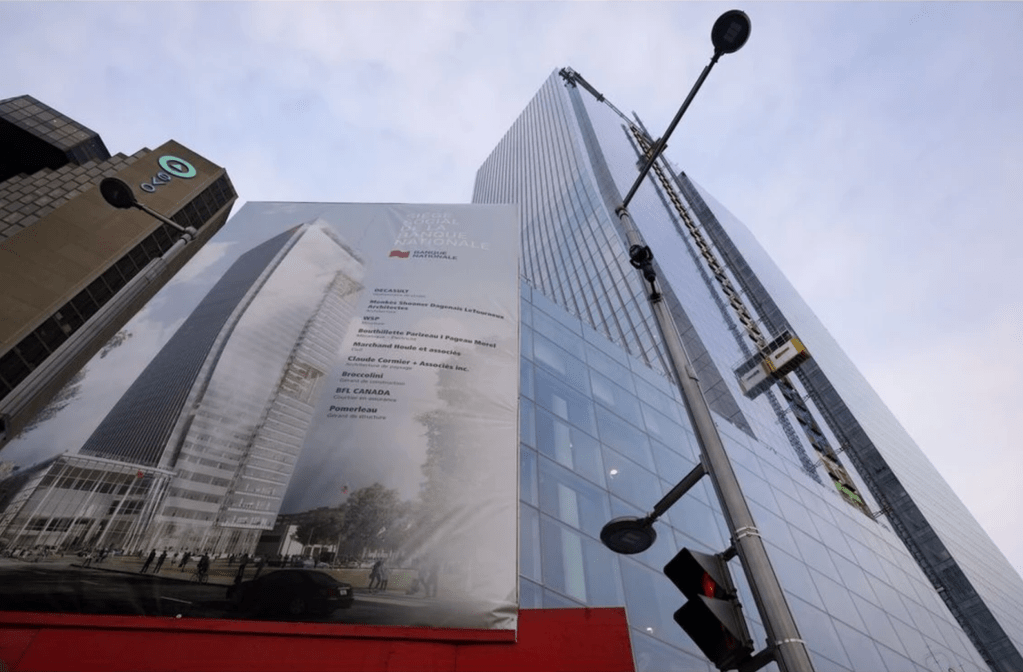

National Bank Hits Record, Extends Lead Over Canadian Rivals

February 28, 2024

National Bank of Canada closed at a record high after it reported earnings that wowed analysts, widening its lead over the country’s other large lenders in shareholders returns.

Read it now on Bloomberg

Bank of Montreal Cuts Exposure to Ultra-Long Mortgages in Canada

February 27, 2024

Bank of Montreal is slowly whittling down a pile of ultra-long mortgages that it granted to Canadian customers to help them handle the rapid rise in interest rates.

Read it now on Bloomberg

Canada’s Biggest Grocer Hits All-Time High Twice in One Week

February 22, 2024

Loblaw Companies Ltd. set an all-time high for the second time this week as Canada’s biggest grocer rallied on a fourth-quarter earnings beat and expansion plans.

Read it now on Bloomberg

Rate-Cut Delays Are a Headwind for Canadian Stocks, IG Strategist Petursson Warns

February 16, 2024

Canada’s main equity index is poised to struggle if investors determine that central banks are going to delay rate cuts for a while, IG Wealth Management’s chief investment strategist said.

Read it now on Bloomberg

Canadian Stocks Fall by Most in Over a Year on Hot US Inflation Data

February 13, 2024

Canadian equities had their worst day in more than a year after US inflation data came in stronger than expected and as a steep decline in shares of Shopify Inc. weighed on the benchmark index.

Read it now on Bloomberg

Canada’s Largest Telecom Cuts 9% of Jobs as Outlook Is Soft

February 08, 2024

BCE Inc., Canada’s largest telecommunications firm, will cut jobs by about 9%, undertaking its largest workforce restructuring in nearly 30 years.

Read it now on Bloomberg

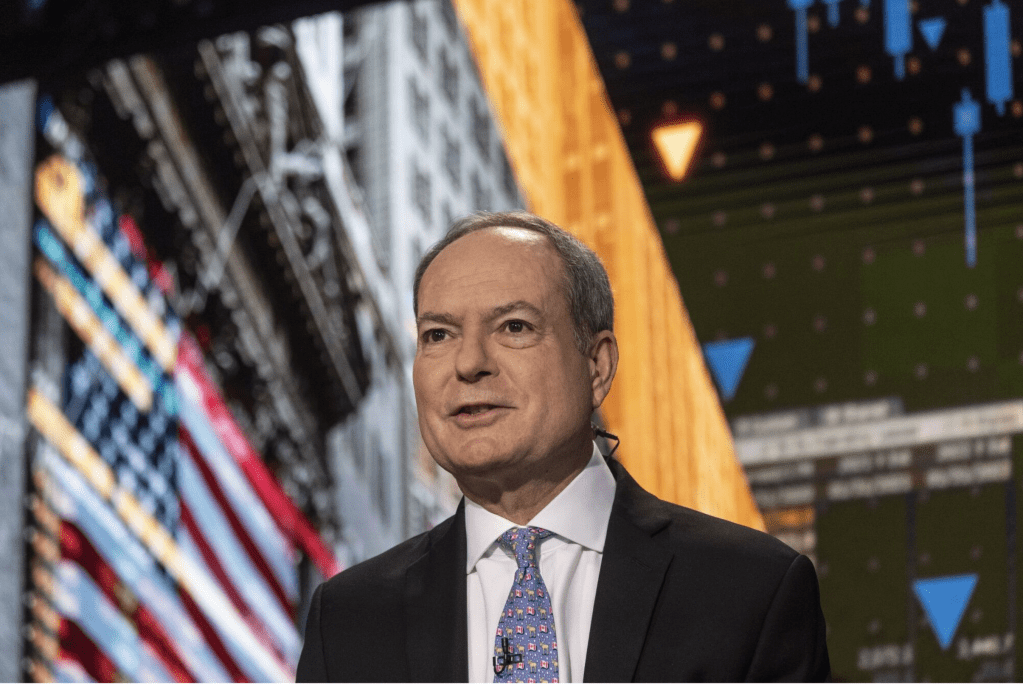

‘Own Canada,’ Says BofA Analyst Pointing to Record Dividend Gap

February 05, 2024

Canadian stocks are attractive, given the dividend growth that the benchmark S&P/TSX Composite Index offers and the prospect of waning disinflationary pressure, says Bank of America Corp.’s Ohsung Kwon.

Read it now on Bloomberg

Billionaire’s Bid for Canada Bookstore Chain Blasted by Analyst

February 02, 2024

Canadian billionaire Gerald Schwartz’s offer to take Indigo Books & Music Inc. private for about C$62 million ($46 million) is “wholly inadequate,” according to the only Bay Street analyst who still covers the retailer.

Read it now on Bloomberg

Toronto Mayor Opts for Less-Than-Expected 9.5% Property Tax Rise

February 01, 2024

Residents of one of Canada’s least affordable cities will likely face a 9.5% property tax hike in 2024 — but it could have been worse.

Toronto Mayor Olivia Chow announced the tax on Thursday with the release of the city’s budget. Residents will also be asked to pay an 8% property tax hike plus a 1.5% bump-up tax for the City Building Fund, bringing the total increase to 9.5%.

Read it now on Bloomberg

Rogers Beats, Sees 20% Cash-Flow Boost in 2024 After Shaw Deal

February 01, 2024

Rogers Communications Inc. beat analysts’ fourth-quarter estimates and released a bullish outlook for 2024, forecasting that service revenue will rise at least 8% and free cash flow will jump.

Read it now at Bloomberg

Grocery CEO Pushes Back Against Canada Minister’s Food-Price Criticisms

January 30, 2024

The head of one of Canada’s largest supermarket chains rejected criticisms from a government minister who said grocery sellers aren’t being transparent enough about food inflation and the sector isn’t competitive enough.

Read it now on Bloomberg

BlackBerry Stock Hits 20-Year Low After Private Debt Offering

January 26, 2024

BlackBerry Ltd. shares hit its lowest point in about 20 years this week after the software company offered convertible senior notes in a push to cut down on its debt.

Read it now on Bloomberg

Canadian National Railway Maintains Earnings-Growth Forecast as Shocks Subside

January 23, 2024

Canadian National Railway Co. is sticking with its outlook for double-digit profit growth over the next few years, shrugging off a 2023 marred by labor strife, low grain shipments and a sluggish economy.

Read it now on Bloomberg

Growth Slump Has Analysts Questioning BCE’s Dividend Strategy

January 18, 2024

Telecommunications company BCE Inc. is a favorite of income-seeking investors in Canada because, for about 15 years, it has delivered annual dividend hikes of 5% or more. But the streak may be about to end.

Read it now on Bloomberg

Gildan Activists Turn Up Heat on Board for Shareholder Vote

January 4, 2024

Canadian investment firm Turtle Creek Asset Management Inc. is backing another shareholder’s push to change the board of Gildan Activewear Inc., saying the company needs a “swift resolution” to the battle over who should be CEO.

Read it now on Bloomberg

GM Leads as Automakers Score Biggest Boost in Canada Sales Since 1997

January 03, 2023

Vehicle sales kicked into a higher gear in Canada last year, with auto companies reporting the biggest annual growth in sales in more than 25 years.

Auto sales clocked in at 1.664 million, an 11.8% boost from 2022, according to a report from DesRosiers Automotive Consultants Inc.

Read it now on Bloomberg

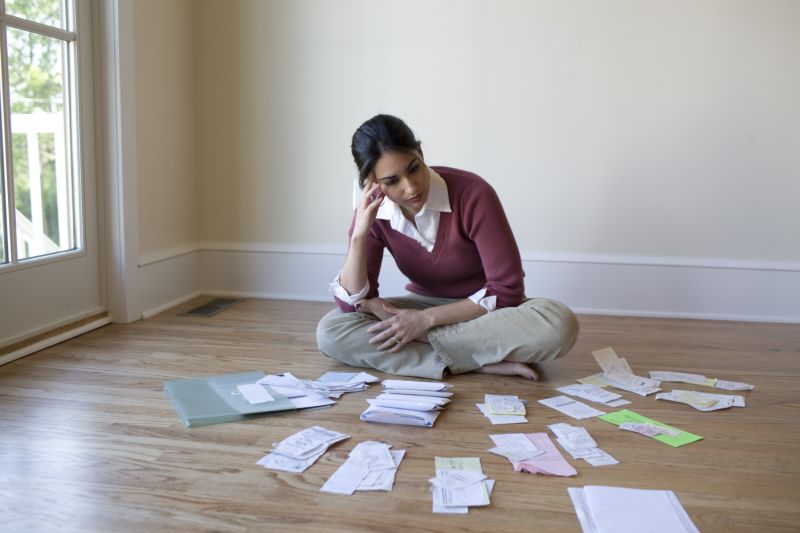

Toy Orders, Parka Sales Illustrate Why Canada’s Economy Is Stalling

November 13, 2023

Canadian companies are painting a stark picture of a consumer who’s pulling back on spending, as rising debt payments and inflation force households to change their behavior.

From big-box retailers to toy marketers to coat manufacturers, recent corporate earnings results and executives’ comments underscore how quickly the economic temperature is changing after two years of robust growth.

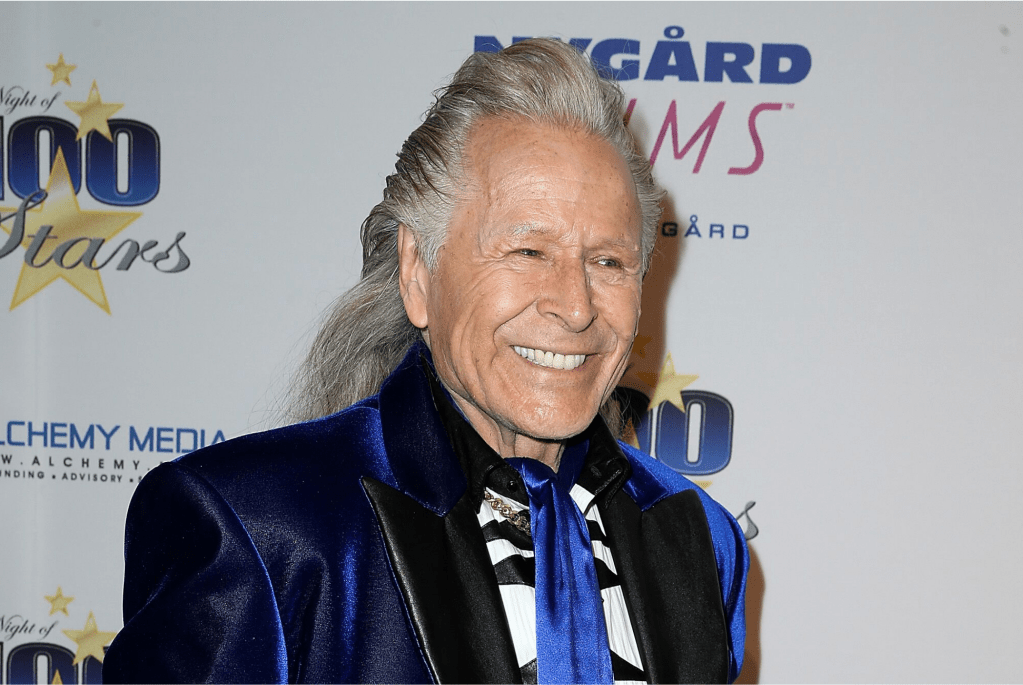

Peter Nygard Convicted of Sexual Assault in Canada Court

November 12, 2023

Peter Nygard, the former Canadian fashion magnate, was found guilty on four counts of sexual assault in a Toronto court after several days of deliberation by a jury.

The verdict, delivered Sunday morning, followed weeks of testimony from five women Nygard was accused of sexually assaulting. The women shared detailed accounts in court of how Nygard invited them to his company’s headquarters in downtown Toronto before assaulting them. The names of his accusers are protected by a court-ordered publication ban.

Major Retailer’s Struggles Flash Warning Signs for Canadian Economy

November 9, 2023

Big box retailer Canadian Tire Corp. will cut 3% of staff and eliminate most vacant roles as consumers tighten spending on non-essential goods, especially in regions where housing costs are highest.

Comparable sales slipped 1.6% in the third quarter, the Toronto-based company said Thursday. Spending was particularly soft in British Columbia and Ontario, the company said, two provinces where homes are most expensive, as residents put more of their take-home pay into rents or mortgages after interest rates rose.

Canada’s Largest Telecom Cuts Spending After Blow From Regulator

November 6, 2023

BCE Inc., Canada’s largest telecommunications company, said it will chop capital spending by C$1 billion ($730 million) after a regulator ordered the country’s major phone providers to open up their broadband networks to smaller rivals at prescribed rates.

The decision by Canada’s telecom regulator applies to Ontario and Quebec, two provinces where more than 60% of the population lives, and is intended to bring more competition to home internet services and reduce costs for consumers.

Canada Stocks Rally the Most in Nearly a Year, Led by Advances in Tech Shares

November 2, 2023

Canada’s benchmark stock index posted its biggest one-day jump in nearly a year, rebounding from a late October slump as tech shares rallied.

The S&P/TSX Composite index ended the trading day 2.9% higher at 19,626.34 points on Thursday, marking the largest gain since Nov. 10, 2022. Shopify, Inc., Lightspeed Commerce Inc. and Dye & Durham Ltd were among the top tech advancers for the index, with increases ranging from 12% to 21% as of 4 p.m. Toronto time.

Canada Goose Shares See Their Longest Ever Losing Streak

November 1, 2023

Canada Goose Holdings Inc. shares extended their longest ever losing streak, falling for an 11th day, after the luxury parka retailer slashed its fiscal year earnings outlook, citing macroeconomic pressure.

The stock hit a fresh intra-day low on Wednesday at C$13.60 ($9.80) after the company reduced its fiscal year total revenue forecast to a range between C$1.2 billion and C$1.4 billion, short of the C$1.42 billion that analysts had expected on average. The company’s previous range was C$1.4 billion to C$1.5 billion.

Read it now on Bloomberg

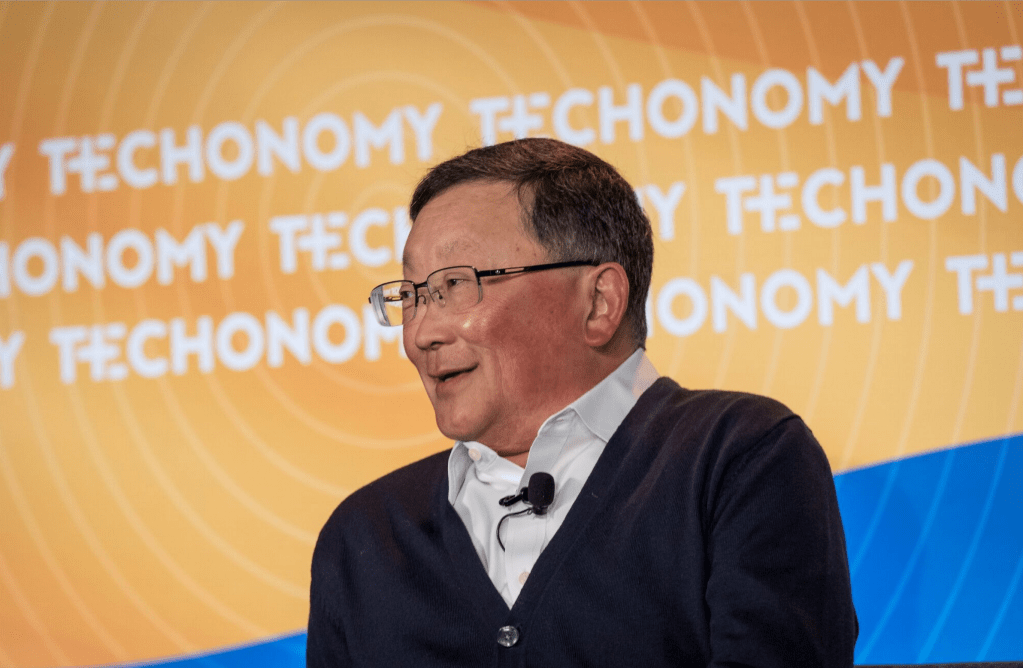

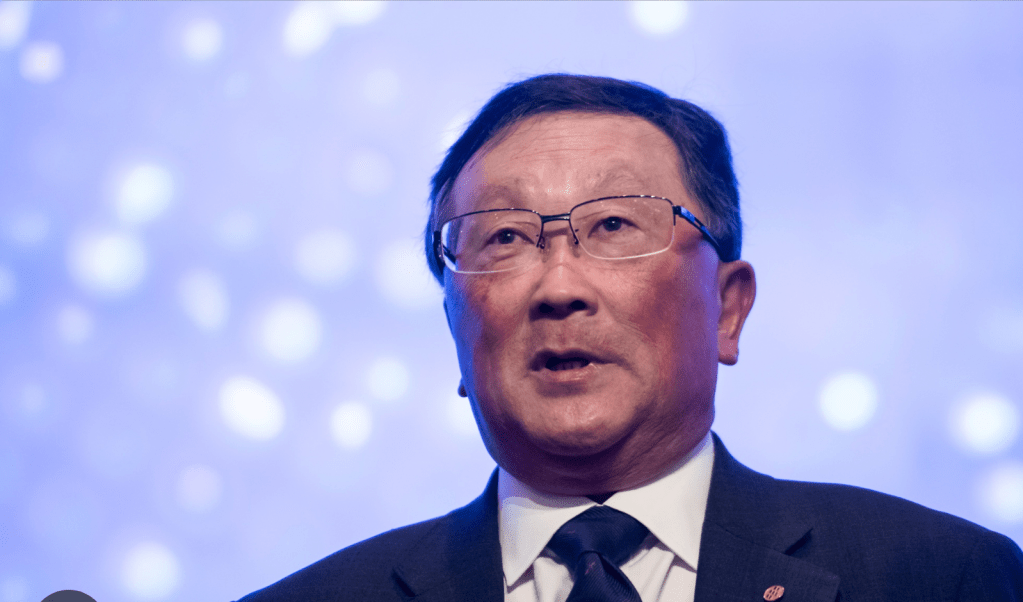

BlackBerry CEO John Chen to Exit With Software Company Planning Split

October 30, 2023

BlackBerry Ltd. Chief Executive Officer John Chen will leave the software company this week, ending a decade-long tenure that failed to deliver a turnaround in its fortunes.

BlackBerry made the announcement on Monday after the market closed, confirming an earlier report by The Globe and Mail newspaper. Richard Lynch will take the helm as chair and interim CEO while the company searches for a permanent replacement.

Read it now on Bloomberg

Canadian Pacific Cuts 2023 Outlook on Cooling Economy, Port Strike

October 25, 2023

Railway operator Canadian Pacific Kansas City Ltd. unveiled a more muted full-year outlook, saying a weakening economy and spate of labor disruptions weighed on freight volumes in the third quarter more than management had anticipated.

CPKC revised its 2023 outlook to say that earnings per share will be “flat to slightly positive” compared with last year on an adjusted basis. Previously, it said it would have mid-single-digit growth this year.

CN Railway Misses Estimates as Consumer Goods Shipments Drop

October 24, 2023

Canadian National Railway Co. spelled out a challenging picture for the North American economy as earnings fell short of expectations in the third quarter, partly due to falling demand for consumer goods.

Revenue dropped 12% from last year to C$3.99 billion ($2.9 billion), missing analyst estimates of C$4.05 billion. On an adjusted basis, the railway’s earnings came in at C$1.69 per share, missing Bloomberg consensus estimates by 3 Canadian cents.

Canada Goose Plunges to All-Time Low as Jacket Sales Look Weak

October 19, 2023

Canada Goose Holdings Inc. shares plummeted to a record low for the second day in a row as economic and consumer pressures prompted a pair of analyst downgrades.

The parka retailer’s stock fell 4.4% to close at $12.16, recovering some of its losses after sinking as much as 9.8% intraday following downgrades from Wells Fargo & Company and TD Cowen. The analysts recommended investors move to the sidelines as the economic outlook for key markets sours while warmer than usual fall weather and weak customer trends are expected to weigh on sales.

Desjardins Cuts Almost 400 Jobs, Citing Slowdown and Volatility

October 19, 2023

Canada’s Desjardins Group joined the list of financial firms reducing staff, cutting nearly 400 employees, mostly in Quebec.

The move primarily affected people in offices in Montreal and in Levis, near Quebec City, a Desjardins spokesperson said, confirming an earlier report by the Journal de Montreal.

Laurentian Bank Slides on Analyst Downgrade Over Credit Risks

October 17, 2023

Laurentian Bank of Canada’s mounting troubles have put its credit rating at risk, according to the latest analyst to downgrade the Montreal-based lender.

A series of snowballing setbacks prompted National Bank of Canada analyst Gabriel Dechaine to cut his rating to underperform from sector perform. It’s his second downgrade in just over a month; he last lowered his rating on the bank in September following Laurentian’s strategic review that ended without finding a buyer. Since then, new challenges have emerged, including a service outage and the departure of key leaders.

Commercial Real Estate Woes in Canada Are Worsened by Tax Gap

October 11, 2023

Commercial real estate owners, battered by higher interest rates, are grappling with another big challenge in Canada: a property tax system that’s increasingly tilted against them, according to a report by Altus Group Ltd.

In several of the country’s largest biggest cities — including Toronto, Montreal and Vancouver — commercial properties are taxed at more than three times the rate of residential ones. The average gap across 11 major cities has widened in the past year, the Canadian real estate data firm said in the study.

BlackBerry’s Spinoff Should Bring Relief to Toronto’s IPO Market

October 05, 2023

There may be some relief in sight for Canada’s beleaguered IPO market: BlackBerry Ltd.’s spinoff its Internet of Things business.

The cellphone giant turned security software provider said Wednesday it’s planning initial public offering of the unit in the first half its next fiscal year, which begins in March. The decision followed a monthslong strategic review that had Wall Street speculating whether BlackBerry would split its segments, sell parts of the business or the whole company, whose market value stood at around $2.5 billion before the announcement.

Toronto Commute Snarled for Hours as Rail Network Goes Down

October 03, 2023

Workers in Canada’s largest city struggled to get home Tuesday after the regional rail system was hit by a “network-wide system failure” caused by an internet collapse at Canadian National Railway Co.

Unusually long lines of people were still waiting for trains to depart downtown around 7 p.m. Toronto time. Metrolinx, the government agency that operates a sprawling rail and bus service between Toronto and its suburbs, said it was attempting to run trains every 30 minutes out of Union Station, Toronto’s central rail hub, which is located in the financial district.

Canada Stocks Erase 2023 Gain, Fall Further Behind US Peers

October 02, 2023

Canadian stocks erased their gains for the year, defying strategists’ bullish outlook and causing the nation’s shares to fall further behind their US peers.

The S&P/TSX Composite Index slumped 1.9% on Monday to its weakest close since October, leaving it down about 1.1% this year.

BlackBerry Sees More Than 50-50 Shot of Wrapping Review Soon

September 28, 2023

BlackBerry Ltd. Chief Executive Officer John Chen expects a “better than 50-50 chance” of wrapping a strategic company review before his contract expires in November, setting up a takeover or overhaul of the former tech darling.

Blackberry, the phone giant turned security software provider, needs to complete a review announced in May, Chen told analysts on an earnings conference call. The uncertainty around the process has compounded concerns about the company’s financial performance.

Peter Nygard Used Status to Lure, Assault Women, Court Hears

September 26, 2023

Former Canadian retail mogul Peter Nygard, once the founder of one of the largest women’s clothing brands in the country, was rolled by wheelchair into a Toronto courtroom on Tuesday morning as the sexual assault case against him began.

Crown prosecutor Ana Serban accused the disgraced business magnate of using his power and influence in the fashion industry to lure young women to his company’s Toronto headquarters, promising them modeling and hostess work, or financial support, and then sexually assaulting them.

Hollywood Stars Ask Toronto Film Festival to Drop RBC as Sponsor

September 13, 2023

A group of Hollywood A-listers including Mark Ruffalo and Joaquin Phoenix are calling on the Toronto International Film Festival to drop the Royal Bank of Canada as a sponsor, calling the firm “one of the most polluting companies” in Canada.

The open letter, signed by over 200 film industry professionals, asks TIFF Chief Executive Officer Cameron Bailey to discontinue the organization’s relationship with Canada’s biggest bank for the 2024 edition of the festival.

Canada’s Stock Market Sees Energy Industry Deepen Its Dominance

September 12, 2023

The Toronto Stock Exchange’s new list of top-performing stocks shows that one of Canada’s dominant industries — oil — is becoming even more so.

Two-thirds of the companies in the TSX30 unveiled Tuesday, highlighting the 30 best stocks over the last three years, are in oil and gas, including seven of the top 10. The No. 1 performer, Paramount Resources Ltd., has climbed a whopping 1,913% in that period.

Sluggish Canadian Banks Face Stock Sales Over Capital Rules

September 06, 2023

With economic storm clouds gathering, Canada’s bank regulator is considering stricter capital requirements that some analysts say have the potential to force Royal Bank of Canada, the nation’s biggest lender, to sell equity.

The banks, which make up the largest sector weighting on the S&P/TSX Composite Index, have dropped 4.6% this year, compared with the 4.3% advance in the broader market as concerns rise about a downturn in the country’s housing market and as quarterly results were largely a disappointment.

Citigroup’s Beaten-Down Shares Are Worth Buying, Mayo Says

September 05, 2023

Citigroup Inc.’s $41 share price reflects too much fear, and investors looking for a long-term opportunity should buy the stock, according to Wells Fargo & Co. analyst Mike Mayo.

The Wall Street bank’s shares are trading at prices that imply its balance sheet could take a big hit from asset losses, analysts led by Mayo wrote. But that seems unlikely given the current strength of the company’s assets and its relatively high capital levels, the analysts wrote.

Mortgage Growth Buckles Under Weight of Rate Hikes in Canada

August 31, 2023

The aggressive pace of interest-rate hikes is hitting mortgage books at Canada’s biggest banks, leading to slowing loan growth, longer amortization periods and a rise in impairments.

Higher borrowing costs cut into mortgage growth, with would-be homebuyers sitting on the sidelines. At the country’s five largest lenders, including Royal Bank of Canada and Toronto-Dominion Bank, residential loan growth slowed to 4 per cent in the fiscal third quarter, compared with annual growth of 9.8 per cent a year earlier.

National Bank Slides on Credit, Trading-Driven Earnings Miss

August 30, 2023

National Bank of Canada’s profit slipped as it increased set-asides for risky loans, trading revenue tumbled and expenses rose. The shares fell to the lowest since early July.

The Montreal-based bank earmarked C$111 million in provisions for credit losses in a more difficult economic environment, about 13% more than expected by analysts in a Bloomberg survey.

Hollywood Strikes Aren’t Putting a Damper on Fall Film Festivals

August 30, 2023

A walkout by superstars Matt Damon and Emily Blunt from the glittering London premiere of Oppenheimer marked the opening shot of Hollywood’s actors strike — crystallizing the image of red carpets drained of glamour.

Yet less than two months after that mid-July show of defiance, and with no resolution to the strike on the horizon, Hollywood luminaries could still light up the premieres at the Toronto International Film Festival next week.

Bank of Montreal Takes Hit on Credit Losses, Tighter Margins

August 29, 2023

Bank of Montreal set aside more money for potentially sour loans and severance costs as it absorbs Bank of the West during a difficult period for U.S. regional lenders.

The Canadian bank earned $2.04 billion on an adjusted basis in the fiscal third quarter, weighed down by weaker results in its US personal and commercial division. That was equal to $2.78 per share, short of the $3.13 expected by analysts in a Bloomberg survey.

Homeowner Stress Bursts Into View in Canada Banks’ Mortgage Data

August 24, 2023

Mortgage data from Canada’s two biggest banks are painting a picture of homeowners straining under high borrowing costs.

Royal Bank of Canada, the country’s largest lender, disclosed that 43 per cent of its Canadian residential mortgages had an amortization period of longer than 25 years, as of July. That’s up from 40 per cent a year earlier, and just 26 per cent in January 2022.

Toronto-Dominion Shares Slide as Deposit Costs Crunch Earnings

August 24, 2023

Toronto-Dominion Bank saw its expenses and provisions for credit losses rise in the third quarter, another signal that borrowers are feeling squeezed by aggressive rate hikes.

The Canadian bank set aside $766 million for troubled loans in the quarter ended July 31, about 4 per cent more than analysts had projected.

Telecom Giant BCE Poised for Turnaround as Dividend Yield Soars

August 23, 2023

The stage is set for a comeback for BCE Inc. shares after the battered telecom giant’s dividend yield reached multiyear highs this week.

BCE — one of Canada’s big three cable providers — has slumped 7.7 per cent so far in 2023 but its dividend yield rose above 7 per cent this week, levels last reached during the global financial crisis and at the start of the Covid-19 pandemic in March 2020.

Canada Bank Results Seen Hit by Expenses, Strained Consumers

August 23, 2023

After months of underperforming the broader market, Canada’s Big Six banks are likely to continue struggling as expenses and loan-loss provisions rise and consumer finances deteriorate.

Higher interest rates are expected to hurt lenders’ fiscal third-quarter earnings when they begin to report Thursday. Inflation data on both sides of the border have ratcheted up bets that central banks could raise rates further still, which would further erode spending power and borrowing demand. Analysts expect that higher rates could have banks bracing for elevated funding costs and lagging loan growth.

Barclays Analyst Lifts Target Prices for Canadian Bank Stocks Before Earnings

August 21, 2023

Barclays Plc is boosting its price targets on most Canadian bank stocks, saying expectations are so low that fiscal third-quarter results may bring some upside surprises.

Analyst John Aiken raised his target on seven of eight banks — Canadian Imperial Bank of Commerce was the only exception. If banks’ profits look better than forecast, the shares may be poised to trade at higher valuations, Aiken said in a note to investors Monday.

Canada Bank Earnings to Take Hit From Capital Markets, M&A Slump, RBC Says

August 09, 2023

Slumping capital markets and M&A revenues are set to hit earnings at Canada’s biggest banks when they report this month, according to Royal Bank of Canada.

RBC analyst Darko Mihelic chopped his profit forecast on five major Canadian lenders, citing a dearth of deals. The dollar value of mergers and acquisitions handled by the country’s largest banks likely dropped 77 per cent in the fiscal third quarter compared with a year ago, Mihelic calculated, based on data compiled by Bloomberg.

Telus Plans to Cut 6,000 Jobs Globally as Profit Slides

August 04, 2023

Telus Corp. said it’s seeking to eliminate 6,000 jobs, or 6% of its workforce, after posting second-quarter profit that missed analysts estimates.

The cuts comprise of 4,000 workers at Telus and 2,000 at Telus International and includes offers of early retirement and voluntary departure packages, the Vancouver-based telecommunications company said Friday in its earnings statement. The reductions will cost Telus as much as C$475 million ($355 million) this year, and are expected to yield C$325 million in annual savings. Telus had 108,500 employees at the end of 2022.

Canaccord Cuts About 75 Jobs in Canada as Global Dealmaking Slows

August 1, 2023

Canaccord Genuity Group Inc. cut about 75 jobs in Canada, primarily in its capital markets division, amid a dearth of dealmaking activity.

The terminations on Tuesday represent about 7 per cent of its 1,200 workers in Canada, according to people familiar with the matter.

National Bank Grows Tech Book With SVB’s Canadian Portfolio

August 1, 2023

National Bank of Canada’s deal for Silicon Valley Bank’s Canadian commercial loan portfolio will give it more exposure to higher growth industries and still leave the Montreal-based lender with enough capital to take a run at Laurentian Bank, according to analysts.

Canada’s sixth-largest lender agreed to buy the SVB Canadian commercial loan portfolio from First Citizens Bank on Tuesday. The loan book is comprised of approximately C$1 billion ($752 million) in loan commitments of which around C$325 million are outstanding and are in the technology, life science and global fund banking sectors, according to a statement.

Laurentian Bank Shares Dive With Pool of Buyers Dwindling

July 28, 2023

Laurentian Bank of Canada shares tumbled as much as 9% on a report that Bank of Nova Scotia and Toronto-Dominion Bank dropped out of the running to acquire the Montreal-based lender.

The decline reverses some of the gains Laurentian made earlier in the month when it announced it was conducting a strategic review with the potential for a sale. The shares surged as much as 44% the next day, the most since 1989.

Hollywood Strike Clouds ‘Barbenheimer’ Bump for Movie Stocks

July 21, 2023

As buzz builds into the premieres of Barbie and Oppenheimer, some on Wall Street are doubting whether the films will be enough to power further gains in movie-theater stocks as a strike by Hollywood writers and actors clouds the outlook for the industry.

JPMorgan Chase & Co. downgraded its recommendation on Cinemark Holdings Inc. this week, saying the actors’ walkout limits visibility into the film supply. Analyst David Karnovsky noted that the strike has already halted production for several movies slated for the second half of next year.

Laurentian Bank Soars by Most Since 1989 Amid Deal Speculation

July 12, 2023

Laurentian Bank of Canada surged the most since 1989 Wednesday after kicking off a strategic review looking into potential buyers.

The Montreal-based lender, Canada’s eighth-largest by assets, jumped as much as 44% following the announcement, made after the close Tuesday. Shares pared gains later in the session, trading up about 27% as of 1:36 p.m. Toronto time.

AI Investing Craze Bypasses Canadian Stock Indexes, for Now

July 10, 2023

The craze in artificial intelligence investing has bypassed Canadian equities markets and left its key index to chase higher-flying stocks in New York. Strategists in both countries think that will reverse in the second half of 2023.

The S&P/Toronto Stock Exchange Composite Index has eked out a 2.2 per cent gain so far this year, directly in line with the Dow Jones Industrial Average. But it has vastly underperformed the S&P 500, which is up 15 per cent, thanks to a surge in its biggest market sector — information technology — that’s been fuelled by an AI investing bonanza.

Read it now on Bloomberg

Carnival Stock Has Room to Run Even After Record Month, Jefferies Says

June 30, 2023

Carnival Corp. shares have never seen a month this good and at least one analyst says investors should be expecting more of the same.

The cruise-line operator jumped 9.7% on Friday, pushing its gains for June to a record 68% after Jefferies upgraded its rating to buy from hold and boosted its price target to a Street-high $25. Competitors Royal Caribbean Cruises Ltd. and Norwegian Cruise Line Holdings Ltd. also traded higher.

Banking headwinds just getting started, so hold off buying the Big Six

June 13, 2023

Canada is still in the early innings of a credit cycle that could weigh on the Big Six banks for the remainder of the year, according to analysts at the Bank of Nova Scotia.

In a note earlier this month, analyst Meny Grauman and associate Felix Fang said that despite better-than-expected job numbers and consumer credit metrics, it’s too soon to get excited about the Big Six.

Cracks appear in Canada’s jobs market as unemployment rate rises for first time in almost a year

June 09, 2023

Canada’s unemployment rate rose in May for the first time since August 2022 as the labour market lost some of its steam.

The economy lost just over 17,000 jobs for the month, according to Statistics Canada, bringing the unemployment rate up to 5.2 per cent from the five per cent recorded in April. This fell short of Bay Street economists’ expectation of a gain of more than 21,000 jobs. It’s too soon to call it a trend, but further losses over the next few data releases could signal that Canada’s job market is finally starting to slow.

Interest rates are likely to stay higher for longer, says Bank of Canada deputy Paul Beaudry

June 08, 2023

Persistent strength in the economy means interest rates may have to stay higher for longer to rein in inflation, Bank of Canada deputy governor Paul Beaudry said June 8 when he delivered the central bank’s latest economic progress report.

Beaudry said the economic data since the central bank’s April decision, when rates remained on pause, tipped the balance and pushed the governing council to decide on a quarter-point rate hike in June.

Bank of Canada unexpectedly hikes rate to 4.75% — and economists see room for more

June 7, 2023

The Bank of Canada surprised markets by ending its pause and hiking its key interest rate a quarter percentage point to 4.75 per cent on June 7.

The central bank pointed to stubbornly high inflation and a resilient Canadian economy as the reasons why the governing council decided its monetary policy was not yet restrictive enough to bring growth in the consumer price index back to its two per cent target.

Mortgage growth is slowing, but Canada’s big banks aren’t worried yet

June 6, 2023

Canada’s biggest banks are warning that mortgage growth is slowing and is expected to stay subdued for the rest of the year, as higher interest rates bite deeper into the economy.

Total mortgage volume growth was in the single-digits at most of the Big Six banks in quarter ended April 30, down from double-digit levels last year.

Laurentian Bank beats expectations, hikes dividend but profit slips

June 1, 2023

Laurentian Bank of Canada beat analyst expectations and hiked its dividend in the second quarter, though profit slipped as the bank set more funds aside for bad loans.

Laurentian Bank’s profit slipped to $49.3 million in the three months ending April 30, from $59.5 million a year earlier. On an adjusted basis, Laurentian earned $51.7 million in profit, or $1.16 per share. Bloomberg analysts, on average, had been expecting $1.11 per share.

Odds of Bank of Canada rate hike just went up as economy beats expectations

May 31, 2023

Stronger-than-expected economic growth in the first quarter could force the Bank of Canada to end its pause and hike interest rates again during one of its meetings over the summer, economists are predicting.

Gross domestic product, the country’s main gauge on the amount of goods and services changing hands, expanded at a 3.1 per cent annualized pace over the first three months of the year. It’s a figure that blew past Bay Street’s expectations of 2.5 per cent growth and the Bank of Canada’s own 2.3 per cent projection.

National Bank hikes dividend as earnings beat expectations

May 31, 2023

The National Bank of Canada beat analyst expectations and boosted its dividend in the second quarter as profit grew in the bank’s core banking businesses.

National Bank’s profit slipped five per cent year-over-year to $847 million on a reported basis for the three months ending April 30, weighed down by higher loan loss provisions and expenses. The bank’s adjusted earnings of $2.38 per share were also down from $2.53, but exceeded average Bloomberg estimates of $2.36 per share.

How Canada’s challenger banks are navigating the banking turmoil

May 30, 2023

A wave of upstarts has attempted to take on Canada’s banking oligopoly over the past decade, but these days the challengers are putting the emphasis on collaboration over direct competition.

“We’re not going in a knife fight, head-to-head with the Big Five banks who can spend 10 to 20 times more to acquire a customer,” James Nauss, head of product and strategy, at Calgary-based Neo Financial, told a panel discussion at the May 17 Bankers Summit in Toronto. “I think by finding partnerships with retailers, with other companies who see the value in what we’re offering, we can get to consumers in new ways.”

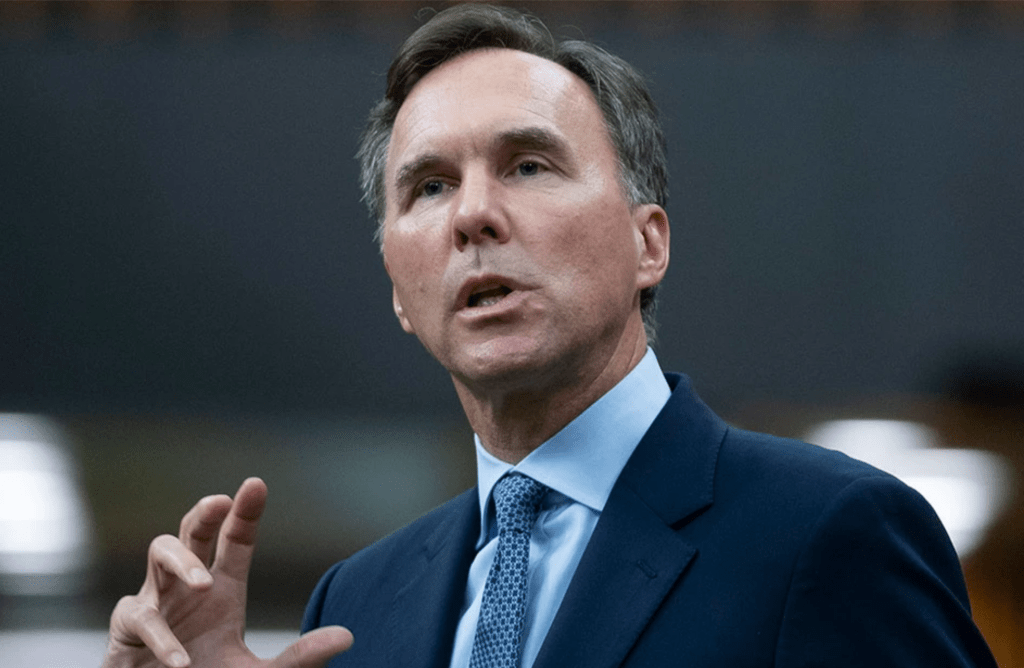

TD won’t hit growth target, announces buyback in wake of First Horizon deal termination

May 25, 2023

Toronto-Dominion Bank has scaled back its medium-term growth outlook and announced it will be repurchasing more than 30 million shares as it navigates the aftermath of the collapse of its US$13.4 billion deal to acquire Memphis-based First Horizon Corp.

The bank revealed the measures on May 25 as it reported second quarter earnings that missed analyst expectations despite profit growth in the bank’s core segments.

RBC misses expectations as costs and credit loss provisions eat into profit

May 25, 2023

The Royal Bank of Canada missed expectations as profit fell in the second quarter on higher credit-loss provisions and staffing and technology costs.

RBC’s net income fell 14 per cent year over year to $3.6 billion in the three months ending April 30. On an adjusted basis, the bank’s profit was down 13 per cent at $3.8 billion. Adjusted diluted earnings per share were $2.65. Bloomberg analysts had been expecting $2.80 per share.

CIBC hikes dividend as profit beats expectations

May 25, 2023

Canadian Imperial Bank of Commerce beat expectations in the second quarter and raised its dividend, despite putting aside more funds for potential credit losses.

CIBC’s net income rose more than 10 per cent to $1.69 billion in the three months ending April 30. On an adjusted basis, the bank’s profit fell two per cent to $1.63 billion, or $1.70 per share. Bloomberg analysts had been expecting $1.63 per share.

Read it now at the Financial Post

BMO misses expectations amid Bank of the West integration

May 24, 2023

The Bank of Montreal missed expectations in its second quarter as the bank set aside more funding for potentially bad loans and recognized costs associated with its acquisition of U.S.-based Bank of the West.

BMO’s net income fell to $1.06 billion in the three months ending April 30, down from $4.76 billion a year earlier. On an adjusted basis, the bank’s profit grew to about $2.22 billion, or $2.93 per share, from $2.19 billion the year before. Bloomberg analysts had been expecting $3.21 per share.

Scotiabank misses expectations on higher loan-loss provisions, but hikes dividend

May 24, 2023

The Bank of Nova Scotia missed expectations in the second quarter as it was hit with a double-digit increase in expenses and put aside more cash for loans potentially going sour if the economic picture darkens.

Scotiabank’s net income fell over 20 per cent to $2.16 billion for the three months ending April 30 as compared to the same period last year. On an adjusted basis, the bank’s profit fell to $2.174 billion, or $1.70 per share from $2.18 per share this time last year. Bloomberg analysts had been expecting $1.76 per share.

U.S. banking crisis casting chill over Canadian banks heading into earnings this week

May 23, 2023

Canada’s banking system avoided taking a direct hit from the U.S. crisis that shook the global financial landscape earlier this year, but the episode is still fresh in market watchers’ minds heading into second quarter bank earnings.

Contagion from the March collapse of California-based Silicon Valley Bank claimed a handful of U.S. regional banks and forced Swiss authorities to engineer a rescue of Credit Suisse. Though the damage stopped short of the Canadian border, the incident has left lingering concerns about potential weaknesses in the financial system and invited additional scrutiny of Canada’s biggest banks, especially those with operations in the U.S.

Bank of Canada sees signs Canadians are having trouble keeping up with their debt

May 18, 2023

The rapid rise of interest rates have left the Bank of Canada more worried about Canadians’ household debt and cracks forming in the global financial system.

The strain of rising mortgage interest costs on indebted households and the aftershocks of the U.S. banking crisis have emerged as two key risks highlighted in the central bank’s latest Financial System Review.

Lenders are taking a more conciliatory approach to insolvencies — and that means fewer bankruptcies

May 16, 2023

Borrowers are struggling to keep up with debt payments in the post-pandemic era, but the more conciliatory approach to highly indebted customers that Canadian lenders adopted following the global financial crisis seems to be keeping outright bankruptcies to a minimum.

March data from the Office of the Superintendent of Bankruptcy showed that consumer and business insolvencies jumped by 28 per cent month over month, a sign that high interest rates are starting to push some households and businesses to the brink. The good news, however, is that consumer proposals — a process where borrowers work out a deal with lenders to pay back a portion of what’s owed — are outpacing bankruptcies by a wide margin.

Canadian banks hit with downgrades as economic storm clouds gather

May 10, 2023

Canadian bank stocks may be running out of runway amid an uncertain outlook and potential recession looming on the horizon, leading some analysts to slash outlooks and hand out downgrades.

Barclays Bank PLC analyst John Aiken downgraded Royal Bank of Canada, Bank of Nova Scotia and Toronto-Dominion Bank on May 9, causing the S&P/TSX financials index to drop by one per cent.

Do you want a digital loonie? The Bank of Canada wants to know

May 08, 2023

The Bank of Canada said it still thinks a digital version of the dollar is unnecessary, but it wants to know what Canadians think about the possibility anyway.

Canada’s central bank stepped up its years-long investigation of cryptocurrency on May 8, initiating a public consultation on the subject of a central bank digital currency. Policymakers said they will take submissions until June 19.

EQ Bank posts record earnings as lending for apartment construction surges

May 04, 2023

Alternative lender Equitable Group Inc. posted record earnings in the first quarter despite some choppy conditions for North American banks.

On an adjusted basis, EQ Bank earned $2.62 per share, outpacing the street’s expectations of $2.44 per share. Rising reported net interest income of $241 million and better-than-forecast credit loss provisions as the bank set aside allowances of $6.2 million for bad loans fuelled the beat.

Read it now on the Financial Post

Toronto home prices, sales rise in competitive spring market

May 03, 2023

Toronto home prices eked out a third monthly gain in April as a tight housing market heated up competition.

The average price of a home in the Greater Toronto Area rose four per cent month-over-month to $1.153 million in April, according to data from the Toronto Regional Real Estate Board. Still, prices were down from their pandemic highs of $1.25 million a year earlier. The number of homes exchanging hands also rose just over nine per cent to 7,531 homes sold from March to April. Sales were down slightly over five per cent from a year ago.

Crisis hits Canadian banks’ deposits in U.S. with TD faring the worst, filings show

May 02, 2023

Canadian banks with operations south of the border are showing some scars from the United States banking crisis, with deposits coming under pressure in the first quarter according to filings with the U.S. Federal Reserve.

On average, deposits at the four Canadian banks with significant U.S. divisions slipped by three per cent quarter over quarter, according to a May 1 note from National Bank of Canada analyst Gabriel Dechaine. The calculations were based on quarterly filings known as call reports made to the Federal Financial Institutions Examination Council. Dechaine said the dip was consistent with what U.S. banks have experienced and that steepest declines were recorded in non-interest-bearing deposits.

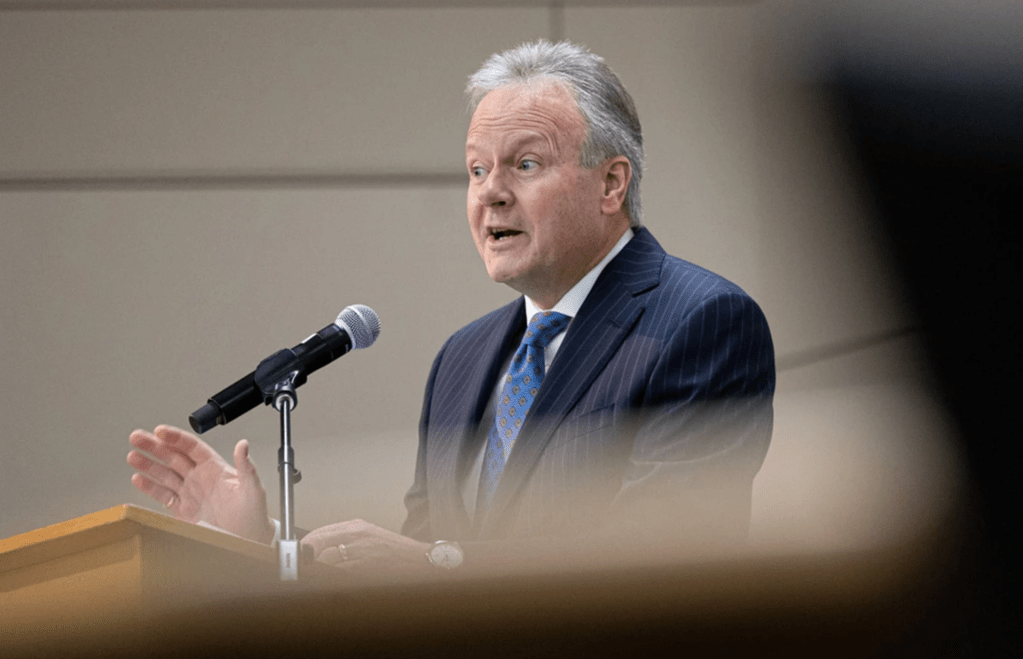

Silicon Valley Bank crisis shows regulators can’t be complacent in digital age, OSFI head says

April 29, 2023

The speed of the deposit flight that led to the failure of Silicon Valley Bank means more questions need to be asked about financial oversight in the digital age, according to Canada’s top banking regulator.

“The global financial system is deeply interconnected,” Superintendent of Financial Institutions Peter Routledge told an April 27 Economic Club of Canada event in Toronto. “Contagion is always a threat, so problems on one part of the system ripple across the globe at lightspeed.”

Population boom proves wild card in Bank of Canada rate decision

April 27, 2023

The Bank of Canada‘s leaders spent “considerable time” discussing the country’s booming population during their latest policy deliberations, concluding that surging immigration could be making the labour market look tighter than it actually is.

Governor Tiff Macklem and his deputies opted to leave the benchmark interest rate unchanged on April 12, but not before puzzling over Canada jobs data that show hiring had remained strong despite their best efforts to slow the economy with higher interest rates.

Toronto’s high-quality office buildings not immune from spike in sublease space

April 26, 2023

Subleased space in Toronto‘s downtown core surged in the first quarter as firms continue to right-size their work spaces following the pandemic work-from-home boom, with even the highest quality office buildings starting to feel the effects.

Downtown Toronto’s sublease availability jumped 13.5 per cent from the fourth quarter of 2022 to over 4.36 million square feet in the first three months of the year, according to data from real estate firm JLL Inc. While the increase wasn’t as high as the 20.8 per cent jump recorded in the fourth quarter of 2022, it marks the third consecutive quarterly of rising sublease space.

Battered fintechs starting to lose faith in promise of open banking

April 26, 2023

Ask any chief executive of a fintech company about fundraising these days and they’ll tell you that capital is much harder to come by since the pandemic tech boom fizzled.

The new, more challenging environment is a far cry from a few years ago, when the fintech world was awash in cash and pressing government for greater access to the data that helps incumbent institutions dominate the financial landscape.

Why a recession might be just what the doctor ordered for Canada’s economy

April 21, 2023

We may be in for some rocky months, but a recession later this year could ultimately help jostle the economy back to a state of normalcy, the Bank of Nova Scotia’s chief economist said this week.

Speaking at the Canadian Fintech Summit in Toronto on April 19, Jean-François Perrault made the case that the past decade-plus has been anything but normal, in economic terms.

TD CEO offers few details on state of First Horizon deal

April 20, 2023

Toronto-Dominion Bank chief executive Bharat Masrani still sees the benefits of merging with Memphis-based First Horizon Corp., but gave shareholders few details on the status of the acquisition at TD’s annual meeting on April 20.

Numerous attendees at the shareholder meeting asked about the US$13.4 billion First Horizon deal’s progress and whether there would be changes to the terms, something banking analysts had speculated on amid turbulence stemming from the collapse of Silicon Valley Bank last month.

BMO chief executive Darryl White eases deposit concerns at shareholders meeting

April 18, 2023

The head of the Bank of Montreal reassured investors that his bank is not grappling with deposit or liquidity concerns, questions that North American banks have been facing since the crisis at Silicon Valley Bank put a range of U.S. regional banks under pressure.

“We have a stable and diverse base of customer deposits and we maintain high quality liquid assets that can be accessed in times of stress,” BMO chief executive Darryl White said during the bank’s annual general meeting in Toronto on April 18.

Schwab’s earnings beat may take heat off TD, but deposit flight leaves questions

April 17, 2023

An earnings beat by the Charles Schwab Corp. may take some of the heat off stakeholder Toronto-Dominion Bank, which has found itself in the crosshairs of short sellers and lagged its Canadian peers in recent months in part due to its 12 per cent holding in the U.S. financial services company.

Charles Schwab’s profits grew by 14 per cent year-over-year in the first quarter to $1.6 billion. On an adjusted basis, the bank’s earnings of 0.93 per share surpassed Bloomberg analyst expectations of 0.90 per share.

Canada’s main inflation indicator will plunge this week: What that means for interest rates

April 17, 2023

The inflation story starts a new chapter this week.

For the better part of a year, the narrative was one of consumer angst amid the worst inflation in forty years, and a central bank’s mission to crush price pressures with a staggering number of interest rate increases.

More recently, the pace of inflation has come off its peak, so much so that the Bank of Canada has paused its rate hikes for the time being. Statistics Canada likely will reveal more good news on April 18, when it likely will report that year-over-year increases in the consumer price index dropped to their lowest since at least the fall of 2021 in March.

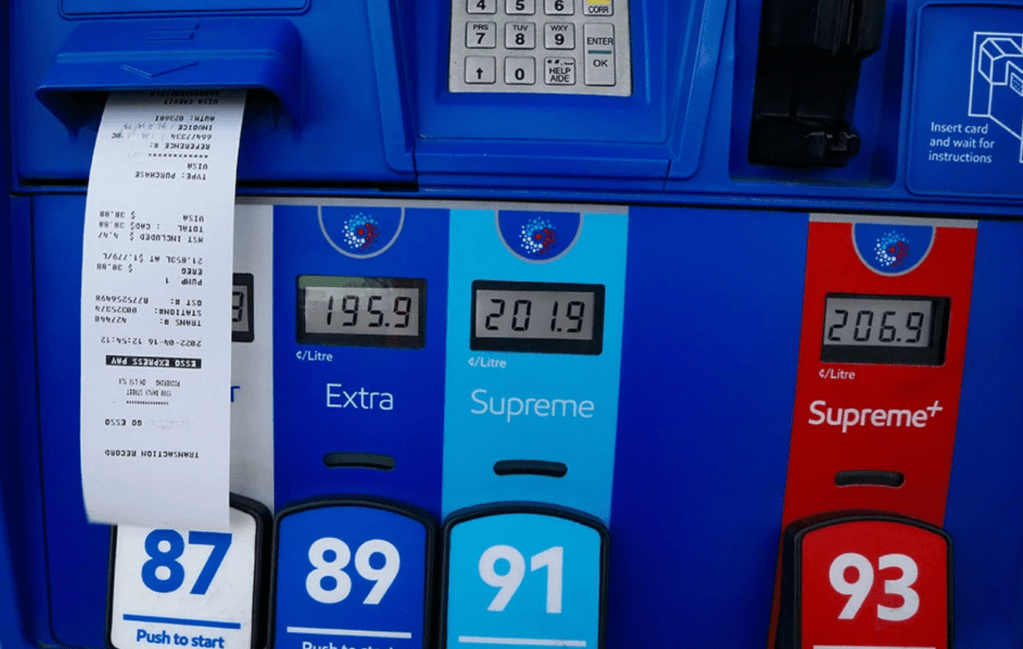

Canadians are about to be hit by the full shock of rising interest rates

April 14, 2023

Canadians are about to feel the full effect of the interest-rate shock the Bank of Canada put in motion a year ago.

Anyone seeking a home loan is seeing the highest interest rates in recent memory. You could get a variable mortgage with a rate of about 1.5 per cent a year ago — and if you did, you’ve had an uncomfortable year, as variable rates are now closer to six per cent, according to Bank of Canada data.

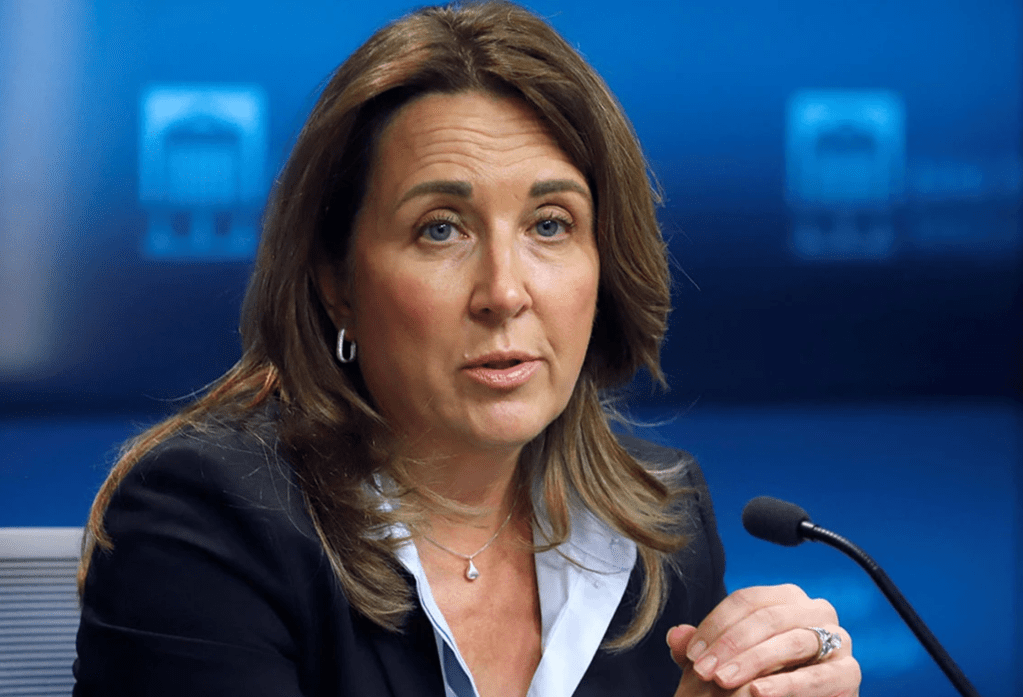

‘The warning signs were there’ before SVB crisis hit, Carolyn Wilkins says

April 11, 2023

The collapse of Silicon Valley Bank was a “missed opportunity” for regulators and those in the financial sector who failed to heed the warnings signs and head off the crisis in advance, according to a former senior deputy governor of the Bank of Canada.

Carolyn Wilkins, who now serves as a senior research scholar at Princeton University, in addition to other roles, made the comments during a university panel discussion about the crisis on April 11.

Scotiabank taps Francisco Aristeguieta as head of international banking

April 10, 2023

The Bank of Nova Scotia is bringing in veteran banker Francisco Aristeguieta to run its international business, in the first major operational change since Scott Thomson became chief executive earlier this year.

Aristeguieta will take the helm on May 1, replacing Ignacio “Nacho” Deschamps, who is set to retire from Scotiabank by the end of the month after serving as international head since February 2016.

Rise in short bets against TD is much ado about nothing, analysts and investors say

April 10, 2023

Toronto-Dominion Bank’s outsized exposure to the U.S. may have put it in the crosshairs of short sellers in recent weeks, but those looking for a bank crisis in Canada will likely end up disappointed, market watchers say.

On April 4, data from S3 Partners showed that short interest in TD totalled $4.71 billion ($3.63 billion on Canadian markets and $1.08 billion in the U.S.). That gave TD the honour of having the largest total short interest of any bank worldwide, according to S3, a fact that made the headlines.

Toronto home prices rise as competition heats up in tight market

April 05, 2023

Toronto home prices may have turned the corner in March as rising competition in a tight market pushed sales and prices higher month-over-month.

While prices were down nearly 15 per cent from the same time last year as demand buckled under the weight of interest rate increases, they were up more than one per cent from February, according to data from the Toronto Regional Real Estate Board.

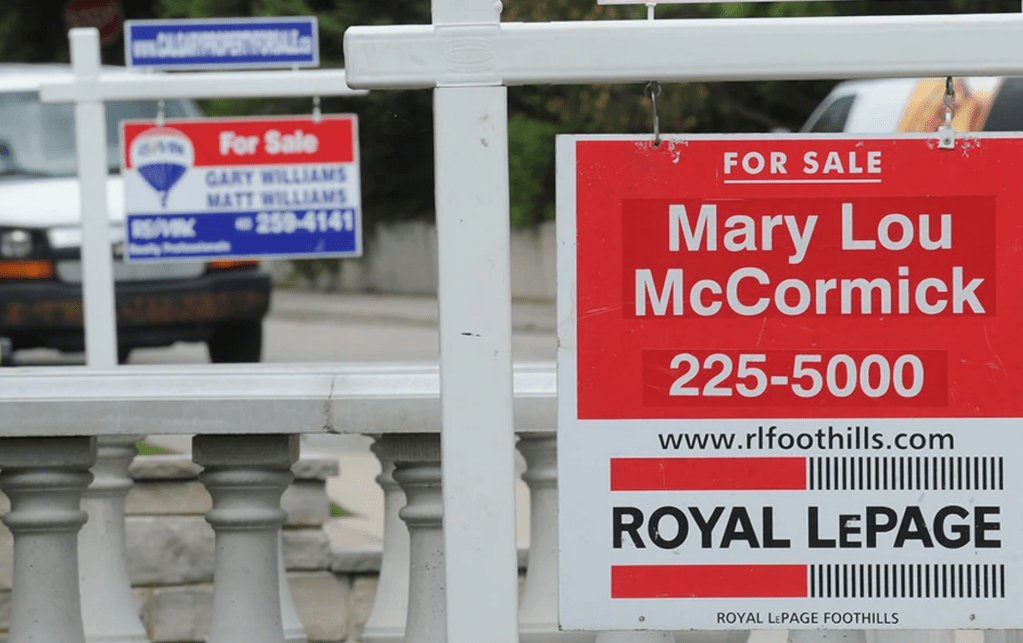

Calgary home prices edge up in March in tight market

April 03, 2023

The price of a Calgary home edged higher in March in a tight market, as potential sellers hold onto their homes for longer.

On average, prices increased two per cent to $541,800 in March from the previous month, and eked out a roughly one per cent gain from the same time last year, according to data from the Calgary Real Estate Board. The number of homes exchanging hands in the city also grew by about 40 per cent from a sluggish February, to 2,432 units sold in March.

WonderFi, Coinsquare and CoinSmart to create largest Canadian regulated crypto asset platform

April 03, 2023

Canadian cryptocurrency companies WonderFi Technologies Inc., Coinsquare Ltd. and CoinSmart Financial Inc. are joining forces to create the country’s largest crypto asset trading platform.

The combined entity is expected to serve 1.65 million registered Canadian users with over $600 million in combined assets under custody. It also plans to launch new products and services similar to those already offered by major international players.

Credit is getting tighter but Canadian banks can weather storm, analysts say

March 31, 2023

Credit is likely to be harder to come by for households and businesses in North America in the wake of the collapse of Silicon Valley Bank, but analysts say Canada’s big banks should be able to hold their own despite a more restrictive lending environment.

U.S. Federal Reserve chair Jerome Powell put issue front and centre last week when the turmoil in the U.S. banking sector would lead to tighter credit conditions that “would in turn affect economic outcomes,” on top of already rising interest rates.

Bank of Canada ‘ready to act’ against banking turmoil, deputy governor Toni Gravelle says

March 29, 2023

Bank of Canada deputy governor Toni Gravelle said the central bank stands “ready to act” against a market-wide financial sector stress, making a point to calm any nerves that remain frayed from the turmoil that came in the wake of the collapse of Silicon Valley Bank almost three weeks ago.

Gravelle told a gathering of financial professionals in Montreal that it is the Bank of Canada’s mission to keep the financial system stable, and that policymakers are confident that banks are much more resilient now than they were during the global financial crisis in 2008.

Budget spending that grows economic capacity may fight inflation, not fuel it, Poloz says

March 29, 2023

The rash of new spending measures unveiled in the federal budget on March 28 may not have the inflationary effect some are predicting because much of the money is being directed to adding capacity to the economy, according to former Bank of Canada governor Stephen Poloz.

In a post-budget report, Poloz argues that the aggressive pace of central bank rate hikes over the past year are already having a cooling effect on overall demand, and supply side spending that boosts capacity should actually contribute to the fight against inflation.

Grocery rebates to junking junk fees: What’s in the federal budget for ordinary Canadians

March 28, 2023

From grocery rebates to tackling predatory lending, Ottawa unveiled more details of its “targeted measures” for Canadians in the newly minted federal budget. Here’s what you need to know about the new measures that could impact your pocketbook:

Ottawa can expect a revenue windfall, but spending will determine the deficit

March 28, 2023

If the provinces are any indication, Ottawa may report a surge in tax revenue when it unveils its 2023 budget March 28, but whether it’s enough to put a dent in the deficit will depend on the government’s spending plans.

Most provinces tabling their budgets over the past few weeks enjoyed tax windfalls from the 2021 assessment season as taxable income grew. The federal government is expected to see a similar revenue bump from pandemic support repayments, higher taxable income and other tax revenues such as the one-time excess profit tax on financial institutions.

Surplus or deficit? Here’s how the provinces stack up financially after budget season

March 28, 2023

The struggle to bring provincial budgets into balance has never been easy and as the pandemic waned, the expectation was for a continued sea of red. But tax and energy windfalls and federal health transfers have flipped the script — notwithstanding certain exceptions. With provincial budget season completed, the Financial Post’s Stephanie Hughes breaks down what you need to know. (Provincial surplus/deficit figures are for fiscal 2023-2024.)

Ontario deficit forecast plunges to $2.2 billion from near-$20 billion as budget unveiled

March 23, 2023

The Ontario government is aiming to bolster economic growth in the province through investment in critical mineral infrastructure and tax credits for manufacturers as part of a budget tabled March 23 that forecasts a dramatically lower deficit for the fiscal year 2022-2023 on higher tax revenue.

Premier Doug Ford’s government is now projecting a deficit of $2.2 billion in fiscal 2022-2023, down dramatically from Budget 2022’s expected near-$20 billion deficit and below the $6.5 billion projected in the province’s third quarter financial outlook in February.

‘They need each other’: Banking crisis amps up uncertainty around TD’s First Horizon deal

March 21, 2023

Toronto-Dominion Bank’s proposed US$13.4 billion acquisition of Tennessee-based First Horizon Corp. was supposed to be the lynchpin of its U.S. expansion strategy, a move that would make it the sixth-largest bank there with US$614 billion in assets and allow it to keep ahead of Canadian rivals who have been building their own operations south of the border.

Now regulatory hurdles and the aftermath of the collapse of Silicon Valley Bank, which has sent the values of U.S. regional banks tumbling, mean the deal is unlikely to be completed on its original terms, and may fall apart altogether.

Silicon Valley Bank shook up Canadian tech lending. Will the big banks fill the void?

March 17, 2023

Silicon Valley Bank built a modest loan book totalling just over $435 million in its four years of operating in Canada, but the collapse of the U.S. based technology lender last week has left outsized questions about who will step in to fill the void in venture lending it leaves behind.

In the immediate aftermath, the big banks and the venture unit of the Business Development Bank of Canada (BDC), which is armed with capital to step in where traditional lenders don’t, have been working with firms caught in the lurch.

OSFI has control of Silicon Valley Bank’s assets in Canada. Here’s what comes next

March 14, 2023

The Office of the Superintendent of Financial Institutions seized the assets of Silicon Valley Bank’s Canadian operations on the weekend after the California-based lender was shut down by U.S. authorities. But just what happens when Canada’s federal bank regulator takes over a financial institution, and what does it do with its assets? The Financial Post’s Stephanie Hughes unpacked the playbook.

How fallout from the SVB collapse could complicate life for some of Canada’s big banks

March 13, 2023

The collapse of Silicon Valley Bank is unlikely to have a significant direct impact on Canada’s Big Six banks, but fallout from the U.S. tech lender’s demise could nevertheless complicate life for those with operations south of the border, analysts said on March 13.

Canadian bank stocks tumbled last week, losing nearly $20 billion in market capitalization, after Santa Clara, Calif.-based SVB suffered a run on deposits and was taken over by U.S. regulators. Bank shares were down again on Monday, with Toronto-Dominion Bank falling the furthest, off nearly three per cent in afternoon trading in Toronto. It closed down 3.43 per cent on the day.

Loonie will be factor when deciding whether interest rates stay on hold: Bank of Canada

March 10, 2023

Bank of Canada senior deputy governor Carolyn Rogers said the central bank will be keeping an eye on the loonie when deciding whether to freeze rates or deliver another hike this year.

The Canadian dollar won’t be the central bank’s main focus. That will be inflation, which Rogers reiterated remains way too high. But she acknowledged that a weaker dollar has the potential to make the Bank of Canada’s attempt to contain price pressures more complicated.

RBC doesn’t see Canada’s housing markets going into ‘free fall’

March 08, 2023

Canada’s real estate market could be more resilient than people think, says the chief financial officer of the country’s biggest bank.

Royal Bank of Canada’s Nadine Ahn described the bank’s mortgage book as healthy even as home prices buckle under the weight of higher interest rates and a possible recession. High immigration levels driving demand amid a supply crunch means the country will still be grappling with an imbalance.

Banks beat the street, but can they outrun the downturn?

March 08, 2023

Most of Canada’s biggest banks beat the street in the first quarter, but analysts and investors alike are holding off on the celebrations.

Mounting expenses, macroeconomic storm clouds and the fact that capital markets were one of the lone bright spots all dampened enthusiasm for the beat.

TD Bank beats expectations with boost from retail banking business

March 02, 2023

Toronto-Dominion Bank posted first quarter earnings that beat expectations on growth in its Canadian and U.S. retail banking operations, results that came amid new uncertainty over the fate of its blockbuster acquisition of First Horizon Corp.

TD’s net income fell nearly 58 per cent to $1.58 billion for the three months ending Jan. 31. On an adjusted basis, the bank’s profit grew eight per cent to $4.16 billion, or $2.23 per share. On average, Bloomberg analysts were expecting $2.20 per share.

National Bank beats expectations despite higher expenses, credit loss provisions

March 01, 2023

The National Bank of Canada beat analyst expectations in the first quarter despite higher expenses as revenues rose in its core banking and wealth management segments.

National Bank’s profit fell five per cent to $881 million in the first three months ending Jan. 31. On an adjusted basis, net income slipped over two per cent to $905 million, or $2.56 per share. Bloomberg analysts had been expecting $2.39 per share.

RBC beats expectations despite profit drop due to higher bad-loan provisions

March 01, 2023

Record capital markets revenue helped the Royal Bank of Canada beat expectations in its first quarter earnings, but it was not enough to fully assuage analysts and investors in the face of a deteriorating credit picture and rising expenses.

RBC reported a 22 per cent year-over-year drop in net income, which clocked in at $3.2 billion for the three months ending Jan. 31 as higher loan-loss provisions and a federal tax weighed on results. On an adjusted basis, the bank’s earnings grew four per cent to $4.3 billion or $3.10 per share, largely fuelled by revenue growth across core banking and capital markets segments. Bloomberg analysts had been expecting $2.96 per share.

Laurentian Bank beats analyst expectations despite profit slip

March 02, 2023

he Laurentian Bank of Canada’s profit slipped in the first quarter as expenses rose and it set aside more funding for loans potentially going bad.

The bank’s reported profit fell by just over six per cent year over year to $51.9 million in the three-month period ending Jan. 31. On an adjusted basis, the bank’s profit was $54.3 million, or $1.15 per share, down nearly nine per cent from a year earlier but ahead of Bloomberg analyst expectations of $1.13 per share.

BMO beats expectations despite profit fall

February 28, 2023

The Bank of Montreal topped analyst expectations in its first quarter, fuelled by strong performances in its trading and core banking businesses, as well as lower-than-anticipated loan-loss provision.

The bank’s reported net income clocked in at $247 million for the three months ending Jan. 31, down from $2.9 billion posted a year earlier, a decline that was largely due to valuation adjustments on its acquisition of BNP Paribas SA’s Bank of the West.

Scotiabank CEO vows to improve shareholder returns after earnings miss

February 28, 2023

The Bank of Nova Scotia will focus on areas of profitable and sustainable growth in a bid to improve returns to shareholders going forward, new chief executive Scott Thomson said Feb. 28 after the bank posted first-quarter results that missed expectations.

“We have not delivered the level of total shareholder returns that our shareholders should expect of us,” Thomson said in his first conference call since taking the helm at the bank earlier this month.

TD Bank to pay $1.2 billion to settle lawsuit tied to Allen Stanford Ponzi scheme

February 27, 2023

Toronto-Dominion Bank has agreed to pay out US$1.205 billion to settle claims it was facing in connection to the Allen Stanford Ponzi scheme case.

The bank said it would pay the amount to the court-appointed Stanford Receivership Estate but denied any liability or wrongdoing in the multi-year Ponzi scheme orchestrated by financier and Stanford Financial Group head Allen Stanford.

CIBC beats expectations despite profit drop as bank earnings kick off

February 24, 2023

The Canadian Imperial Bank of Commerce saw higher revenue across most of its business lines and beat analyst expectations in the first quarter but posted a drop in net income on higher loan-loss provisions and a one-off charge to settle a lawsuit.

The bank reported net income of $432 million, down 77 per cent from $1.87-billion, or $2.01 per share, a year ago for the three-month period ended Jan. 31.

‘Fast and furious’ bank stocks may be running out of road, analysts warn

February 23, 2022

Canada’s bank stocks might have gotten off to a flying start this year, but analysts suspect the tide may be turning against the Big Six as they prepare to report first quarter earnings starting this week.

“Yes, bank shares started off the year on the right foot, but we don’t believe that this Fast and Furious rally can last,” Scotiabank analyst Meny Grauman and co-author Felix Fang wrote in a Feb. 16. note to clients. “To quote the great Vin Diesel in Fast and Furious 4: Tokyo Drift, ‘You know this ain’t no 10-second race.’”

What executive shake-ups at the big banks could tell us about CEO succession planning

February 23, 2023

Change has been in the air in the senior ranks of Canada’s biggest banks in recent months, but industry watchers say it’s too early to tell whether the shake-ups are just routine business or signs that another succession surprise may be coming.

The first shock came in September, when the Bank of Nova Scotia announced that chief executive Brian Porter would retire and be replaced by Finning CEO Scott Thomson, with Thomson officially taking the helm this month.

‘Resilient and innovative’: Energy transition companies lead the pack on TSX Venture 50 list

February 21, 2023

Energy and mining companies with a focus on the green transition have made a strong showing on this year’s Venture 50 list, an annual ranking of the top performing companies on the TSX Venture Exchange.

The list puts the spotlight on some of the lesser known stars among the 3,000-plus publicly traded companies in Canada. This year’s crop, which is broken down into five sectors of 10 companies each, saw an average return of 73 per cent, with mining and energy leading the way with gains of 174 per cent and 89 per cent respectively.

Home Capital posts higher-than-expected provisions for bad loans in sign of mortgage market stress

February 16, 2023

Alternative lender Home Capital Group Inc. set aside more money for bad loans in the fourth quarter than it has at any time since the Financial Crisis in another sign that stresses are forming in the economy.

Provisions for credit losses came in at $10.4 million, doubling the street’s expectations of $5 million. These higher-than-expected provisions weighed on earnings, which clocked in at $0.95 per share in the three months ending Dec. 31 compared to analyst estimates of $1.04, falling 11 per cent from a year ago.

‘Read and react’: How Dave McKay is gearing RBC up for a shallow recession

February 16, 2023

The head of the country’s biggest bank is cautiously optimistic that the Canadian economy will avoid a serious contraction this year and says the lender will wait until the severity of the downturn is known before making any major changes.

“We’re not going to overreact to this,” Royal Bank of Canada chief executive Dave McKay said in a recent interview, before borrowing a phrase from his basketball coaching days to describe his approach.

Canada’s Outstanding CEO of the Year: Royal Bank of Canada’s Dave McKay

February 15, 2023

Bank executives aren’t always what they appear to be. The chief executive title conjures up an image of a stuffy numbers’ nerd focused on meeting targets, growing business lines and slashing unproductive expenses. Dave McKay, chief executive at the Royal Bank of Canada, certainly has banking in his blood. But when he’s not in the boardroom, you may find the 59-year-old catching a pick-up game on the basketball courts or jamming out on one of his 10 or so guitars.

Part-time B-ball player, part-time guitar player and full-time RBC lifer, McKay has worked his way up through the ranks since starting a co-op work placement in 1983 while studying computer programming. Since taking the top spot at the country’s biggest bank in 2014, he has led the acquisition of City National Corp. in 2015, launched a youth-focused skills program in 2017 and, most recently, won the hand of HSBC Canada, Bay Street’s belle of the ball, after weeks of courting from the other Big Six banks.

Half of Ontario insolvencies filed by millennials

February 13, 2023

After the pace of insolvency filings fell during the pandemic, it is now back on the upswing, with millennials leading the pack in 2022.

Millennials accounted for nearly half of total insolvency filings in Ontario (49 per cent) even though they only make up about a quarter of the 18-and-over population, according to the latest Joe Debtor report from Ontario-based insolvency firm Hoyes, Michalos & Associates. Total Ontario insolvencies rose by 15 per cent year over year while Canadian filings rose by 11 per cent and were notably higher than pre-pandemic levels.

How concerns over the housing market factored into the Bank of Canada’s latest rate decision

February 09, 2023

The Bank of Canada for the first time this week released a summary of Governing Council discussions that precede an interest rate decision, giving Canadians a glimpse of the process and a deeper understanding of the economic considerations at play. Here are five key takeaways from the bank’s inaugural summary of deliberations, released on Feb. 8, which address the central bank’s 25-basis-point rate hike in January.

Bank of Canada won’t be cutting interest rates anytime soon: Tiff Macklem

February 07, 2023

Bank of Canada governor Tiff Macklem said market participants who interpret his decision to take a break from raising interest rates as a prelude to cuts might be getting ahead of themselves.

Macklem used a speech in Quebec City on Feb. 7 to reiterate that the central bank would be taking a conditional pause on rate hikes over the months ahead to determine if enough has been done to reverse inflation. However, the governor was definitive that policymakers aren’t planning on cuts anytime soon.

Bay Street thinks Macklem will cut rates to counter a recession in 2023: Bank of Canada survey

February 06, 2023

Most of the biggest players on Bay Street think the Bank of Canada has stopped raising interest rates, and that governor Tiff Macklem will be compelled to cut borrowing costs before the end of the year to keep a mild recession from turning into a severe one.

The Bank of Canada on Feb. 6 released its first quarterly survey of “market participants,” giving the general public access to the kind of consensus forecast that financial data outfits such as Bloomberg LP and Thomson Reuters Corp. provide their clients. The central bank also will now have a benchmark of its own with which it can test its own assumptions.

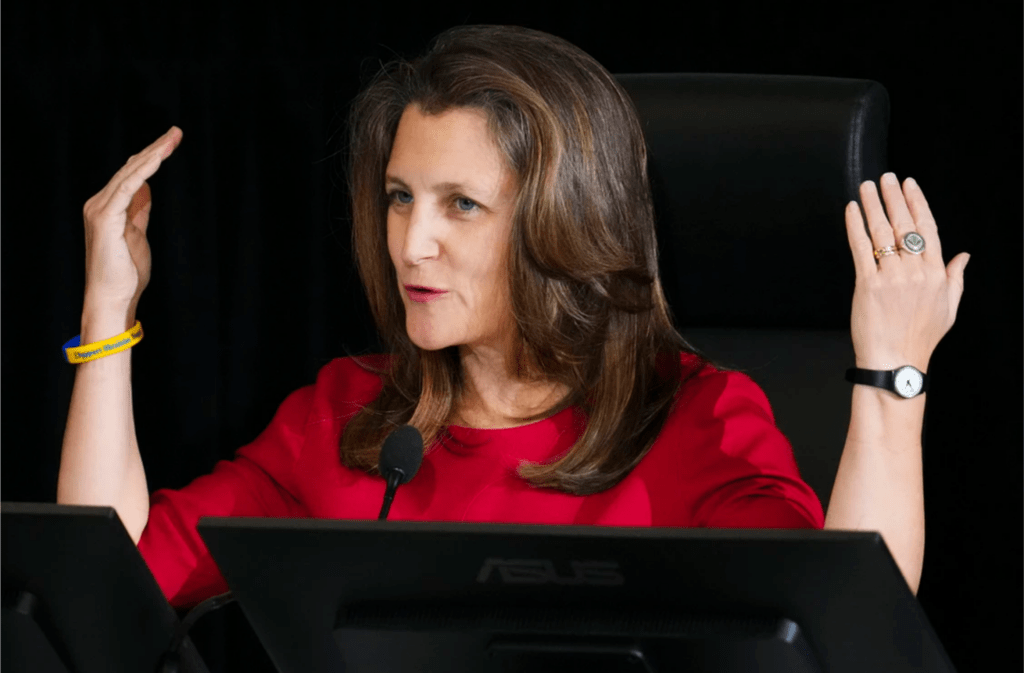

Freeland pledges fiscal prudence to avoid feeding inflation even as demands for spending grow

February 03, 2023

Finance Minister Chrystia Freeland said Canada has a “once in a generation” moment to invest in infrastructure that will improve the delivery of health care and help combat climate change, but emphasized that she still must show restraint because the economy is at risk of sliding into a recession.

Freeland made the comments after a meeting with her provincial and territorial counterparts in Toronto on Feb. 3. The main topics on the agenda were investments in the green transition and health funding for provinces, a long-standing issue that at times has created friction between the federal and provincial governments and one that was put into greater focus during the pandemic.

IMF raises growth outlook for first time in a year, expects inflation has peaked

January 31, 2023

The International Monetary Fund says the outlook for the global economy has become rosier for the first time in a year amid positive signs from China’s reopening and economic resilience in other parts of the world.

The IMF is now projecting that world economic growth will fall from 3.4 per cent in 2022 to 2.9 per cent in 2023, which stands at least 0.2 percentage points higher than the forecast the organization made in October 2022. Growth is then expected to rebound to a pace of 3.1 per cent in 2024.

Ottawa’s spending is making the Bank of Canada’s job harder: John Manley

January 30, 2023

Former finance minister John Manley joined a growing group of “business Liberals” who are voicing their concerns over the federal budget, saying he thinks Prime Minister Justin Trudeau’s fiscal policy is making it harder for the Bank of Canada to contain inflation.

Manley, who now serves as a senior adviser at law firm Bennett Jones LLP, said he agreed with former Bank of Canada governor David Dodge’s report last week that concluded federal deficits are not sustainable for the next 10 years.

Friends of the Liberal government are adding to the pressure on Freeland to constrain spending

January 28, 2023

A growing chorus of voices associated with the Liberal camp are raising the alarm about the nation’s finances, adding to the pressure on Finance Minister Chrystia Freeland to restrain her colleagues’ propensity to spend.

The federal government’s response to the COVID crisis caused the deficit to widen to $328 billion, or 14.9 per cent of gross domestic product, the highest since 1945.

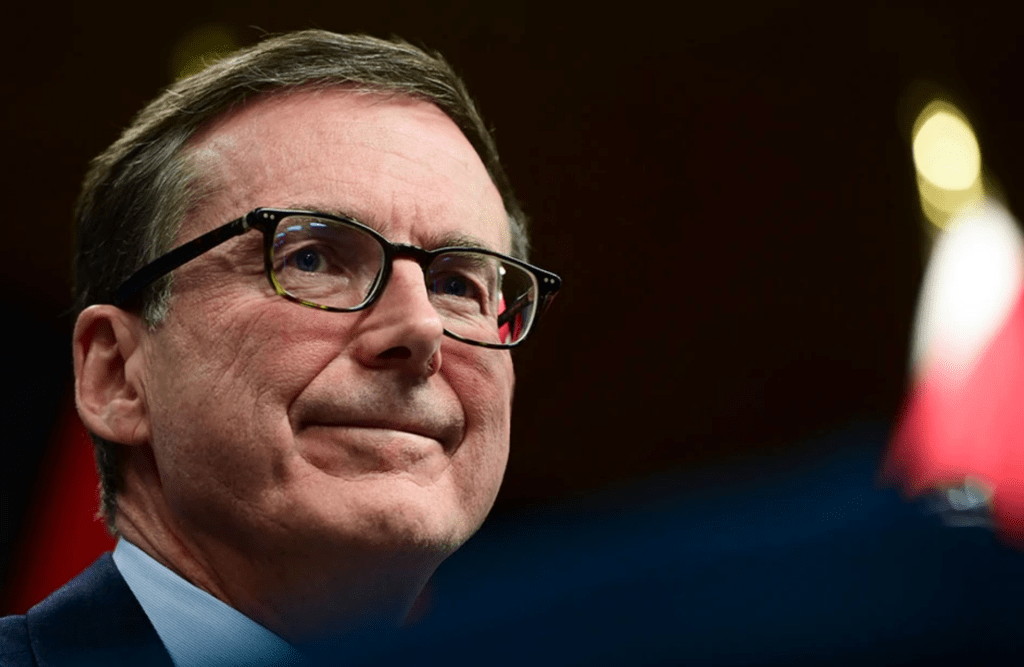

Why David Dodge thinks Ottawa’s plans to restore fiscal balance are on shaky ground

January 25, 2023

The federal government’s carefully charted path back to fiscal balance may be more precarious than it seems, and could be disrupted by a number of daunting economic challenges in the coming decade, former Bank of Canada governor David Dodge is warning.

Dodge, who now serves as a senior adviser to Bennett Jones LLP, noted in the firm’s Jan. 23 fiscal sustainability report that Ottawa will have to stick closely to a plan that limits spending and borrowing as laid out in its Fall Economic Statement if it hopes to bring high debts racked up during the pandemic back down to pre-COVID levels. But it still faces the prospect that the country’s two main fiscal anchors, the debt-to-gross domestic product ratio and a ratio measuring interest costs as a percentage of revenue, remain elevated for years.

Bank of Canada to release meeting summaries for first time ever — but is it enough to improve transparency?

January 24, 2023

The Bank of Canada is so poor at documenting what goes on when its leaders sit down to discuss interest rates that it gave itself a failing grade among its peers.

Monetary policy is made behind closed doors for obvious reasons. But in the spirit of transparency, most major central banks release minutes of their deliberations a few weeks after the decision is made. The Federal Reserve in the United States goes so far as to publish full meeting transcripts after five years.